November 20, 2024

Holiday shopping insights: Lexer retail intelligence

🔓 Insider Alert: This report was originally shared exclusively with our Lexer community, we're now making a summary of these insights available to all. For priority access to future retail intelligence reports and deeper analytical insights, connect with Lexer.

LEXER RETAIL INTELLIGENCE REPORT

We've crunched the numbers from Australia and the US, and we're here to give you the inside track on how to turn this holiday season into your most profitable yet.

The holiday season represents a critical inflection point for retailers. Economic pressures, changing shopping patterns, and increasingly sophisticated consumer expectations have created a complex retail ecosystem that demands strategic agility and data-powered decision-making.

What's included:

- We analyzed 55 leading omnichannel retailers: 40 from Australia and 15 from the US.

- Time Frame: October to December (2021-2023).

- Data points: Sales, orders, returns, discounts, and gift card sales.

Australia

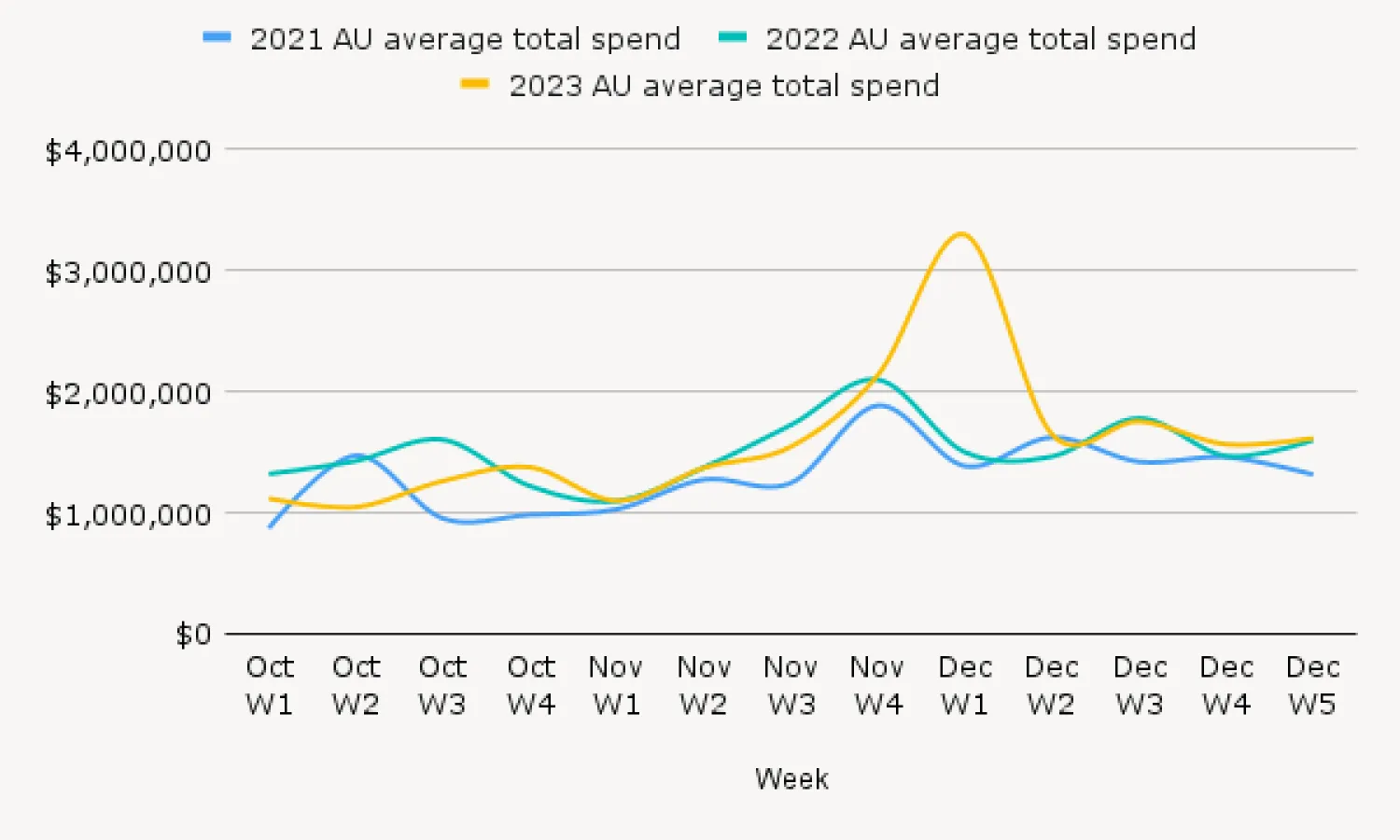

Aussie customers shopped differently in 2023. Black Friday sales soared 120%! Christmas followed with a 7% increase. Customers chased bigger discounts. Late December brought positive change. Week 3 orders rose 6% over 2022. Gift cards were most popular in late December.

BFCM boom. Sales surged 120% as more Aussies adopt Black Friday Cyber Monday.

Steady order growth. The number of orders increased +2% YoY.

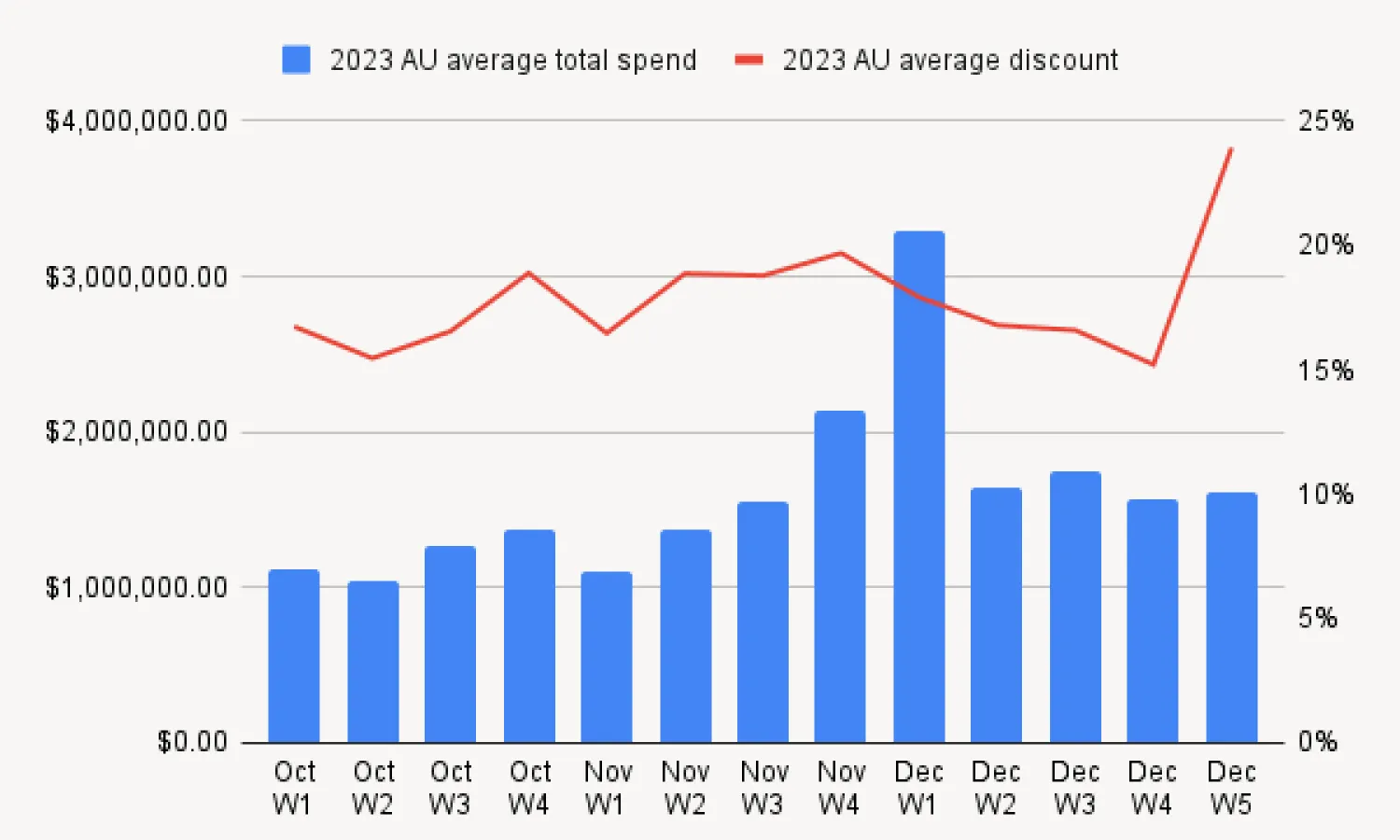

The discount dance. Discounting is a delicate balance between attraction and margin protection.

Average discount percent spiked late, but did not see the same spike in sales.

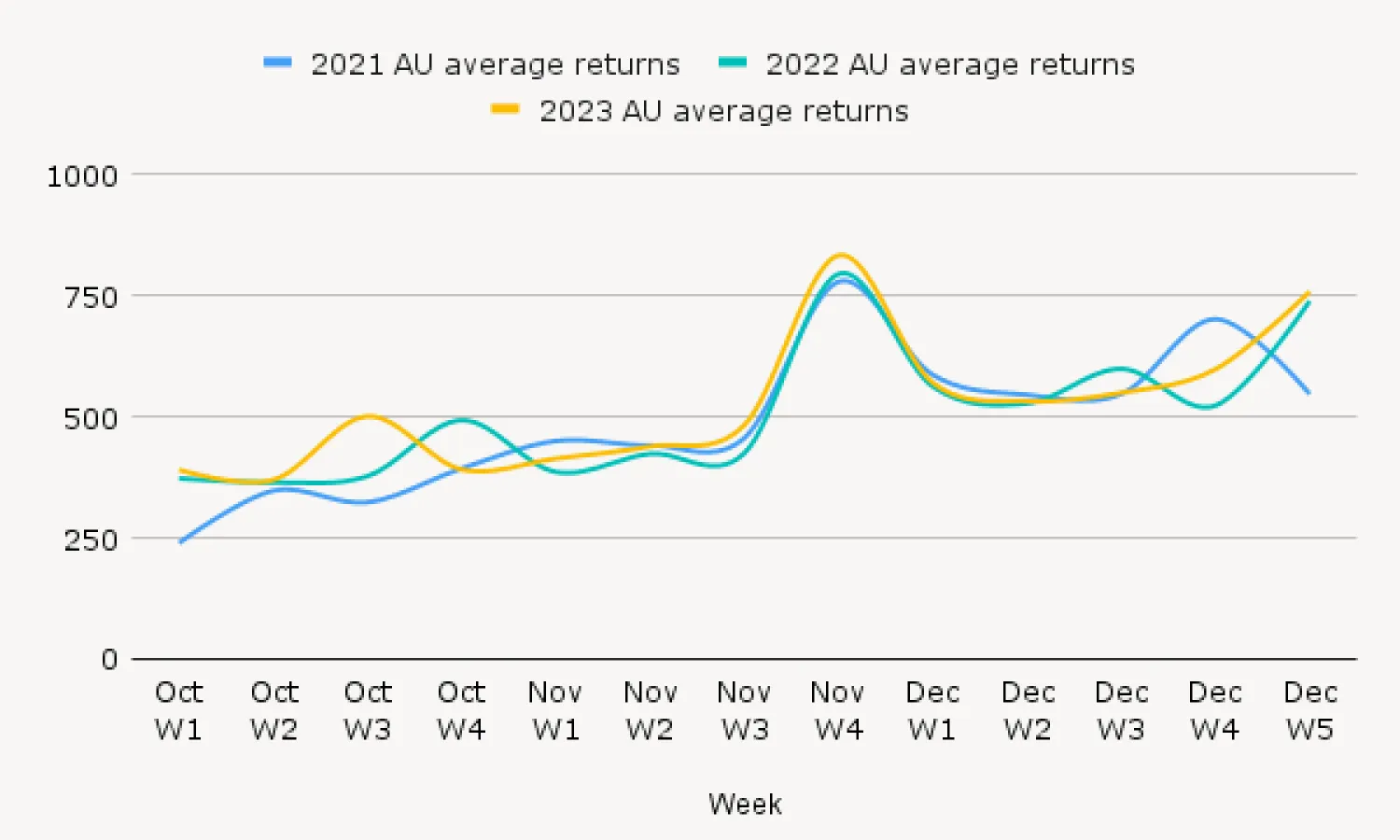

Returns grew +4% YoY. Combat “bracket buying” with size guides, reviews, and smart product recommendations. Turn returns into an opportunity for customer engagement, feedback, and insight.

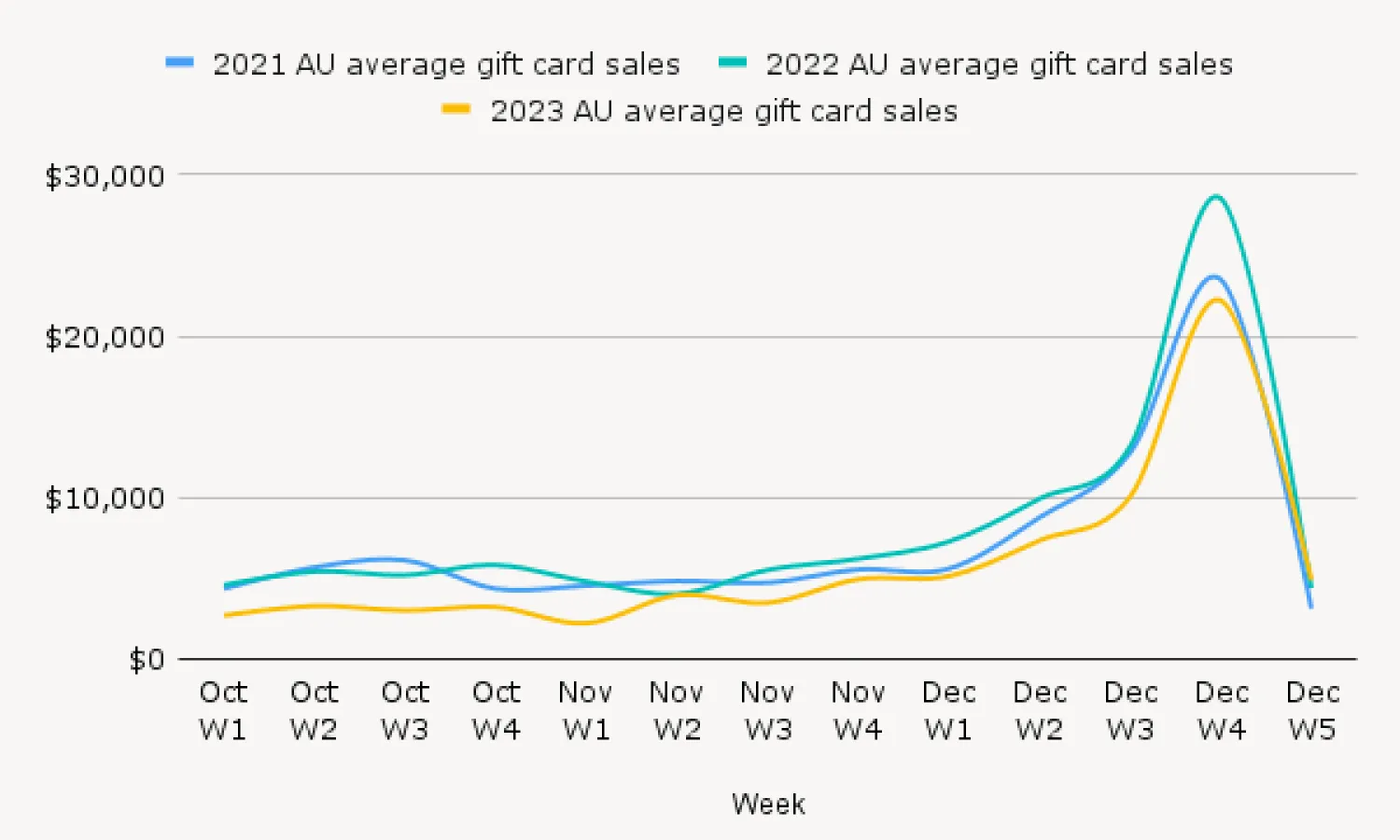

Gift card sales peak the week before Christmas. 2023 saw gift card sales down 27% YoY, perhaps a shift in gift giving preferences? Explore alternative gifting strategies, such as digital experience packages - and make sure to have plenty of gift cards on hand for last minute gift givers.

USA

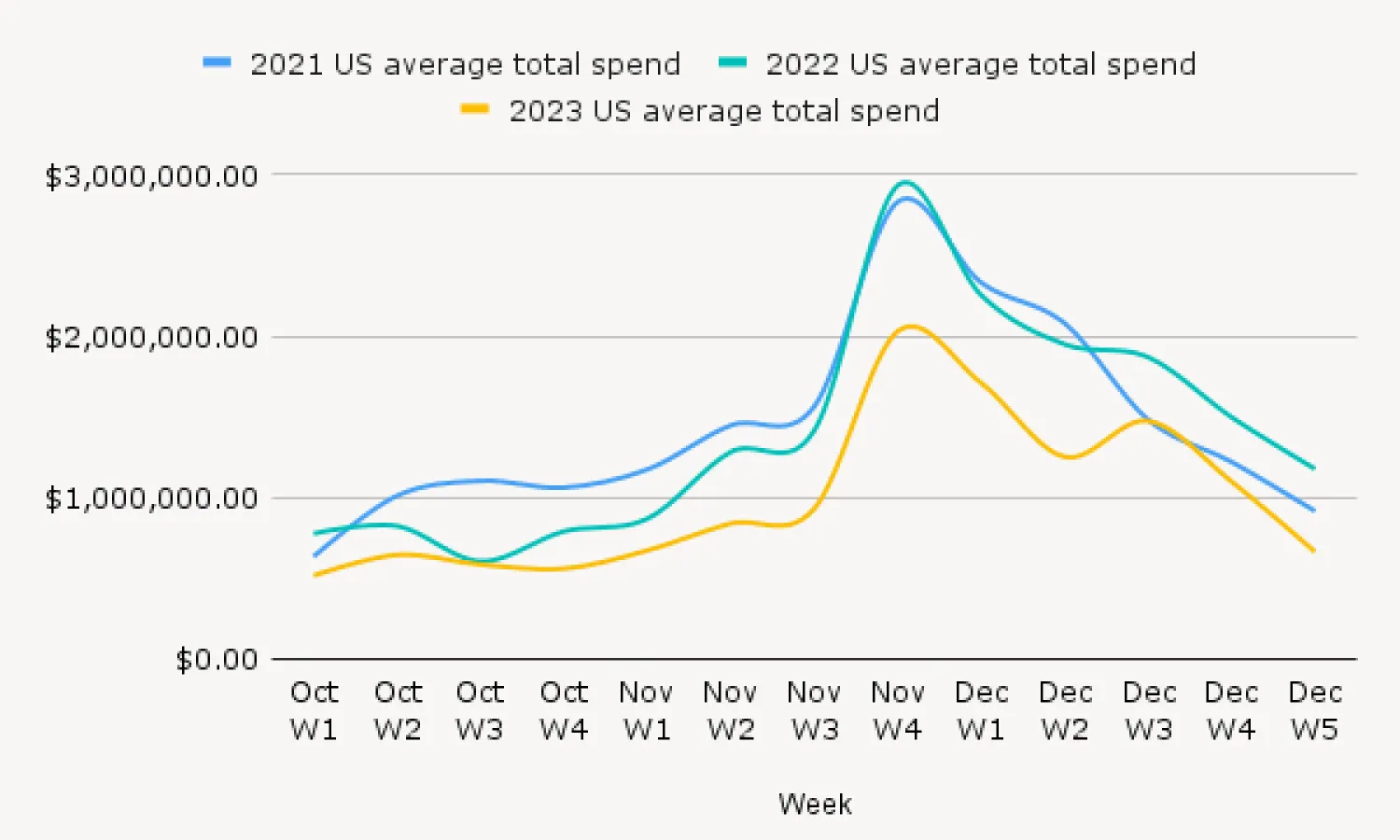

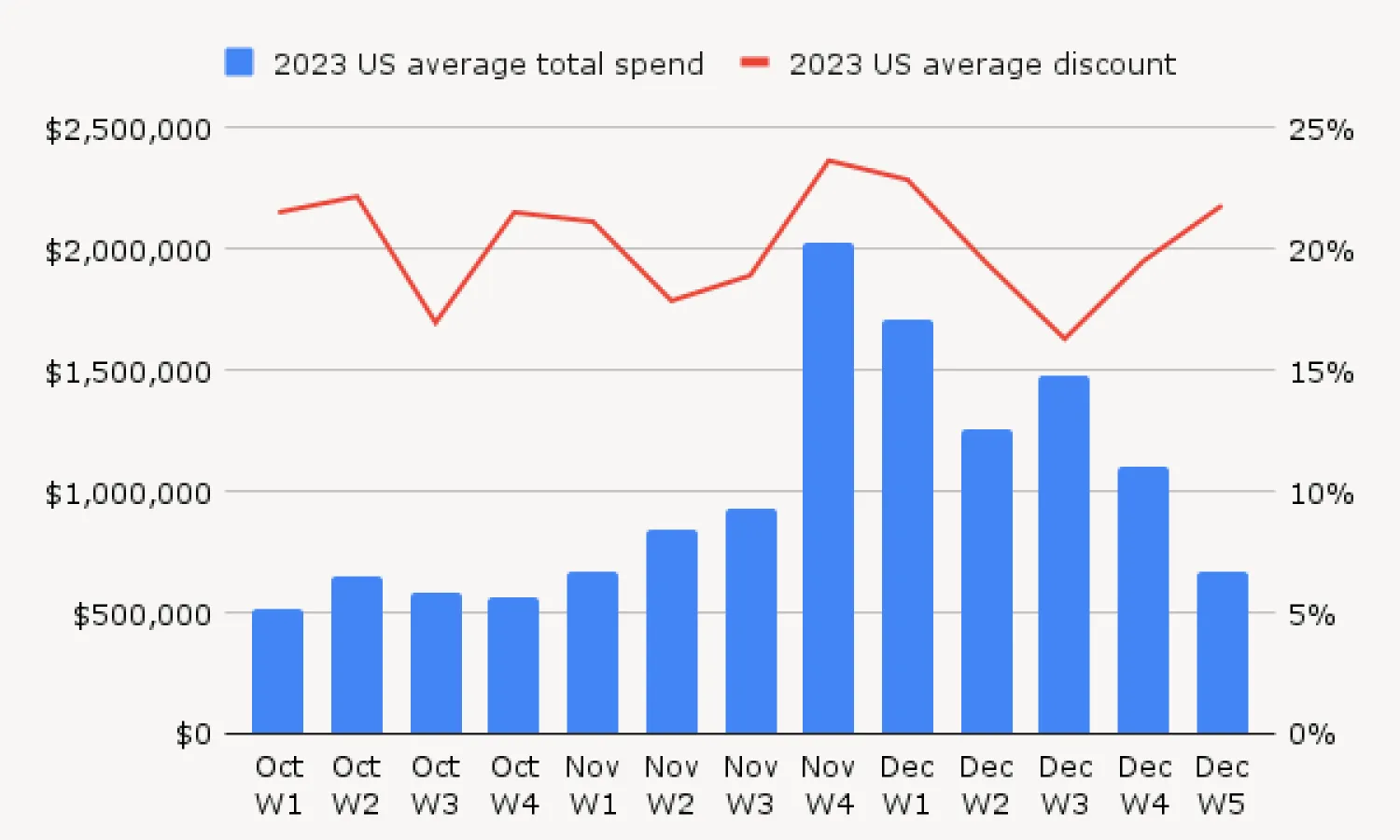

American holiday shoppers spent less in 2023 but took advantage of bigger discounts. This points to increased price sensitivity. Economic pressures likely drove this caution. December showed signs of recovery. Orders jumped 6% in Week 3 compared to 2022. Gift card sales surged in the final two weeks of December for last-minute gifters.

In 2023, average sales dropped by 29% YoY. BFCM is still the primary driver for holiday sales. Early October sales were substantially lower compared to both 2022 and 2021. This could suggest reduced consumer confidence, and more savvy shoppers waiting for discounts.

Order behavior continued to follow a similar trendline. Overall, the average number of orders decreased by 3% in 2023. Focus on key conversion windows, and increased efforts to spread orders over the entire holiday period.

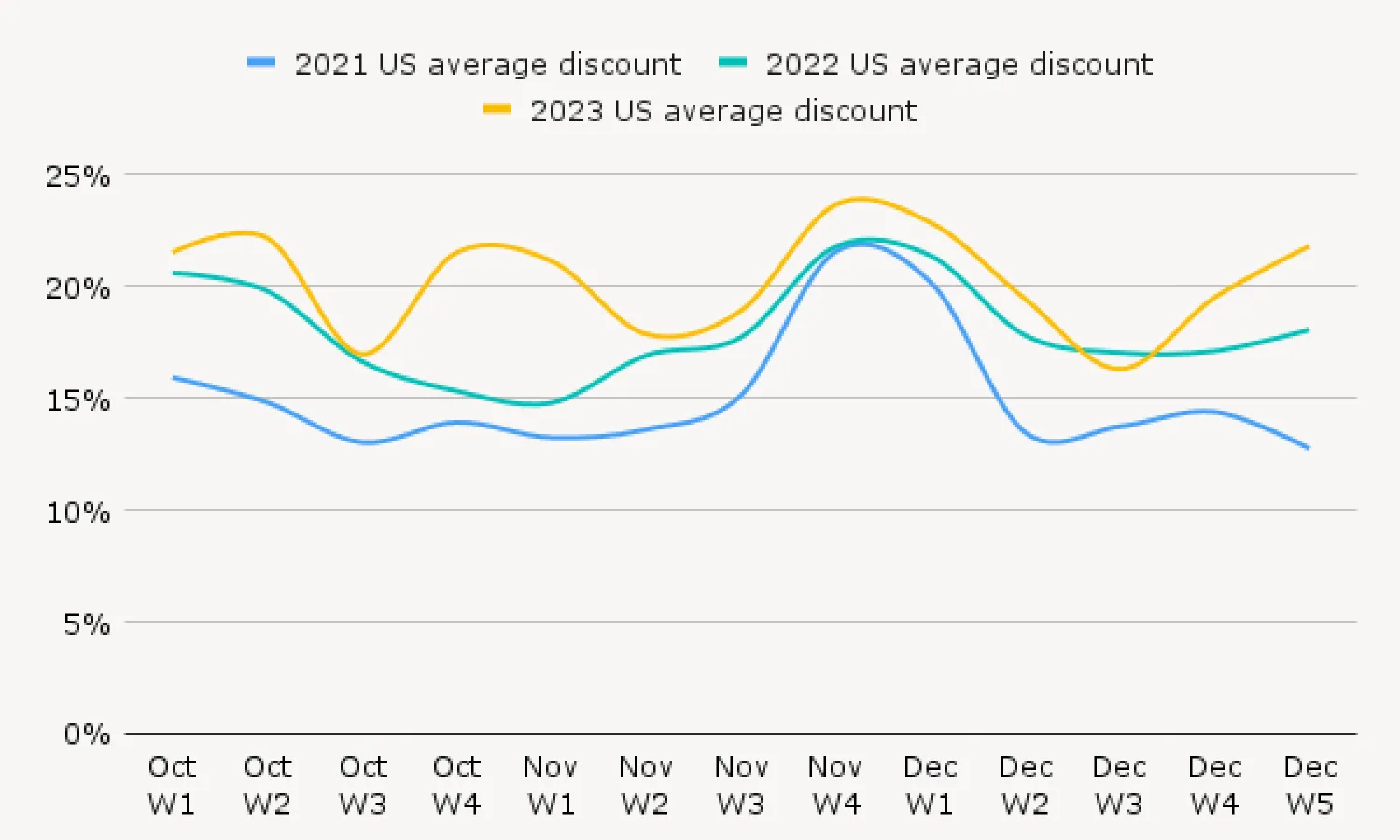

US retailers offered higher discounts than previous years - with the most seen during BFCM and the last week before Christmas.

However, there is still a gap between the discount amount, and the perceived value when looking at sales for the same period.

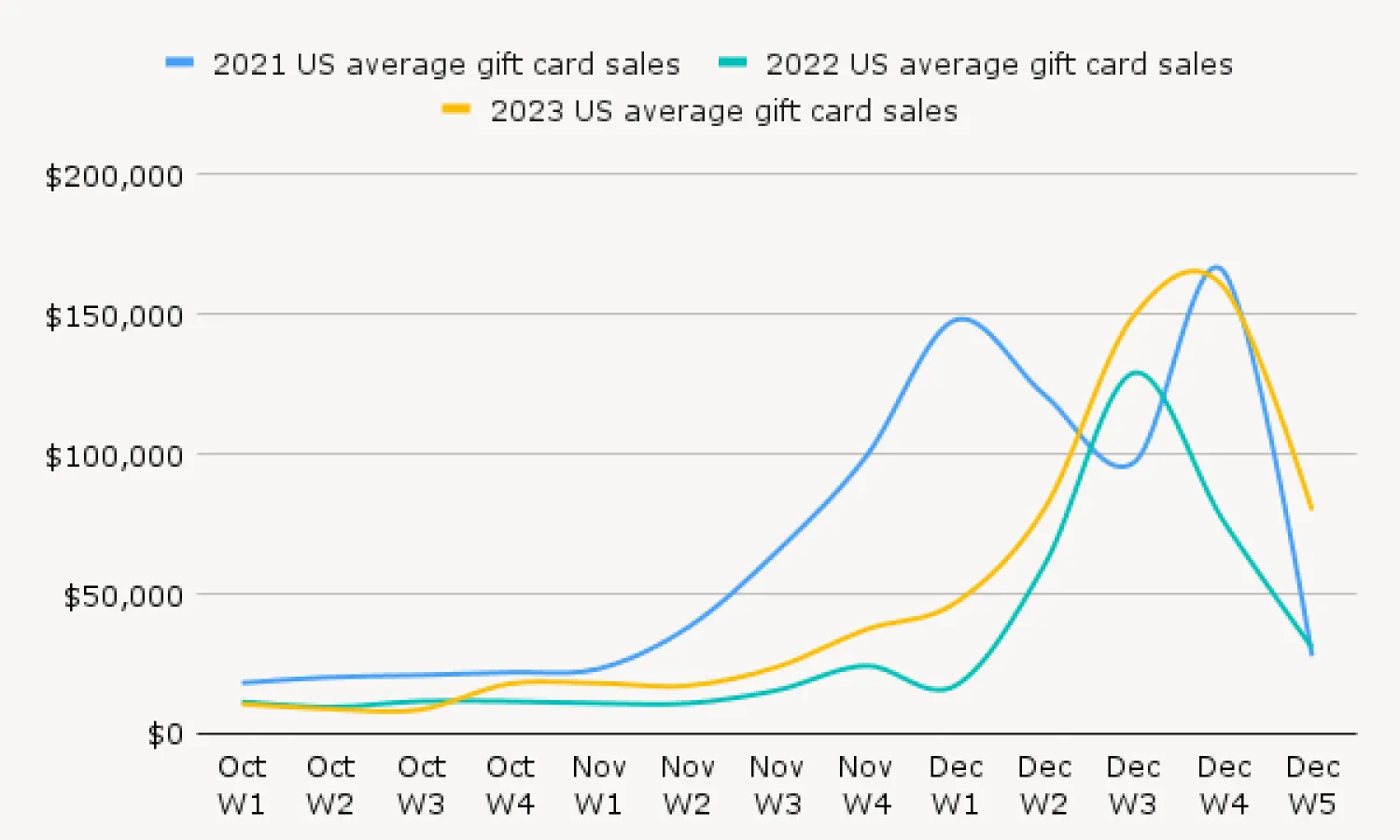

Gift card sales increased 57% compared to 2022, peaking in the final days before Christmas.

Four strategic opportunities

We've identified four strategic areas of opportunity. These aren't just trends—they're data-backed imperatives that will define retail success in the coming holiday season. Here's your playbook for turning insights into impact.

1. Turn returns into revenue

- Use predictive analytics to anticipate return behavior

- Turn December/January returns into in-store traffic

- Create targeted incentives for returners to make a new purchase

- Leverage return feedback to address pain points, size, and fit

2. Go big, go early

- Consumer behavior is shifting earlier

- BFCM now dominates the traditional Christmas shopping period

- Opportunity to capture early-season spending

- Plan promotional calendar with this shift in mind

3. Value-driven promotions

- Combat increased price sensitivity

- Focus on creative bundling strategies

- Design compelling promotional offers

- Balance discounting with - brand value protection, full-price customer consideration, and long-term margin sustainability

4. Experience over everything

- Stores are critical for brand experience

- Use customer data to influence - staff training & deployment, inventory management and merchandising, store locations

- Deploy clienteling tools for - customer data collection, in-person personalization, in-store reporting, post-visit follow up

Ready to transform your Holiday customer strategy? Book a demo with a Lexer retail expert to learn more.

Speak with our retail experts